Common Budgeting Mistakes Startups Make and How to Avoid Them

Can Poor Budgeting Bring Down Your Startup? Suppose you and your team have a new product in mind, and you’ve assembled a great team and set out as an exciting new startup, but you run out of money in just one year. This was the sad tale of many start-ups within Zirtual, a virtual assistant service that shut down in 2015 due to acute cash mismanagement and budgeting mistakes.

According to CB Insights, around 38 per cent of the startups get closed up due to low funding management or because they had low funding. Not having a budget is not a cocktail party oversight but rather one of the main reasons why startups fail.

In this blog, you will learn about the most unhelpful financial management practices that startups make. More importantly, you’ll learn how to avoid startup budgeting mistakes for your firm’s success.

What is the Importance of Avoiding Budgeting Mistakes in Startups

A good working budget ensures understanding, control of resources, and even guarding of the capital required from investors. If finances are not managed well, the organization runs the risk of lacking funding, poor cash flows, and generally poor running of operations.

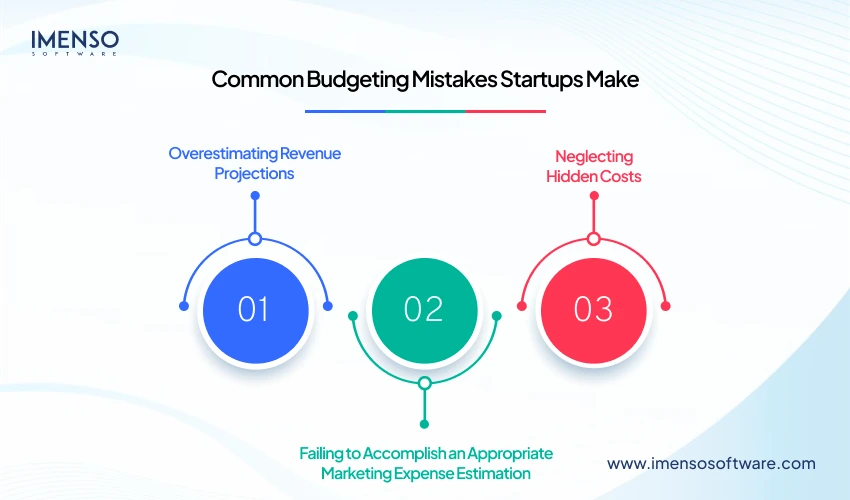

Common Budgeting Mistakes Startups Make

Overestimating Revenue Projections

One of the common budgeting errors is being too optimistic about the revenue.

Enthusiasm is vital, but it shouldn’t take priority over the risk of overestimating. Overestimating can result in financial hardship and excessive spending.

How to Avoid It

- Base your revenue forecasts on market research and historical data.

- Regularly revise estimates based on actual performance.

- Create a conservative version of your budget to prepare for worst-case scenarios.

Neglecting Hidden Costs

Many startups fail to account for hidden expenses such as software subscriptions, taxes, legal fees, and employee benefits. These overlooked costs can quickly accumulate and disrupt your startup budget.

How to Avoid It

- Conduct a thorough audit of all potential expenses.

- Use budgeting tools or hire professionals to ensure no costs are overlooked.

Failing to Accomplish an Appropriate Marketing Expense Estimation

Marketing is one of the most relevant factors contributing to the growth of companies, including startups. However, some business organizations provide inadequate financial resources for advertisement campaigns.

Financial management has a significant impact on your company’s trajectory. It is crucial to identify the right marketing channels and allocate an adequate budget for advertising there. It will ensure that businesses successfully tap into their target audience.

Also Read: How to Build a Resilient Supply Chain for Your Startup

The Impact of Cash Flow on Business Growth: Tips for Founders.

How to Avoid It

- Invest in marketing in your new online start-up company by dedicating at least 7-10 percent of company revenue to the cause.

- This involves tracking the returns on investment for each campaign to determine the amount of money to be spent.

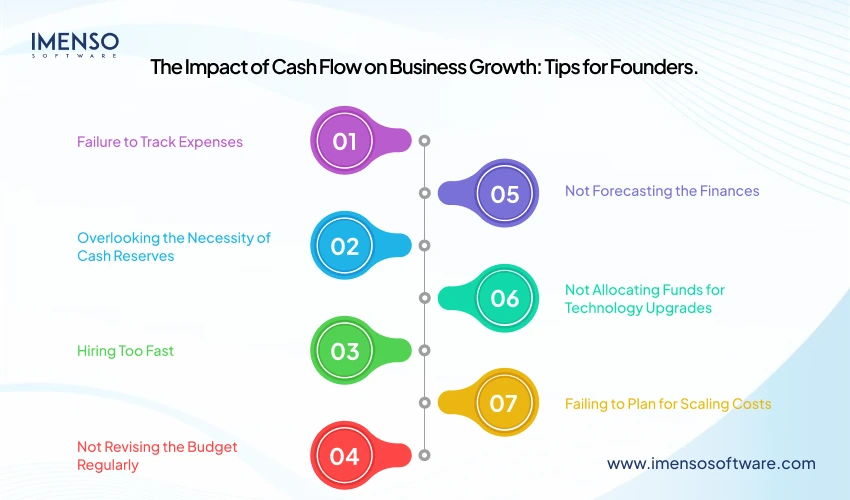

Failure to Track Expenses

With no real-time tracking, expenses can easily get out of hand, causing a budget overrun and financial stress.

How to Avoid It

- Use accounting software for real-time expense tracking.

- Schedule monthly reviews to catch discrepancies early.

Overlooking the Necessity of Cash Reserves

Most startups operate without a financial buffer, making them susceptible to unexpected costs or revenue dips.

How to Avoid It

- Save 3-6 months’ operating expenses as an emergency fund.

- Have a budget for emergencies that include a contingency fund.

Hiring Too Fast

Expanding your team too quickly can strain your finances. This is a common budgeting mistake that growing startups often commit.

How to Avoid It

- Only hire when it is necessary, and the role fits into your growth strategy.

- Outsource the role if a full-time employee is not required.

For specific assignments, offshore web development services help save money and yet deliver value for your project.

Not Revising the Budget Regularly

A stagnant budget is as harmful as no budget at all. Startups operate in a dynamic environment, making regular revisions essential.

How to Avoid It

- Review your budget monthly to adjust for market changes.

- Involve stakeholders to ensure accuracy and alignment with goals.

Not Forecasting the Finances

Most newly established ventures lack adequate financial planning processes for stockholders, where the emphasis is exclusively on short-term costs and objectives. As such, there will be poor financial planning, which may even cost one an opportunity to grow.

How to Avoid It

- Develop a detailed financial forecast covering at least the next 12-24 months.

- Factor in variables like market trends, seasonal fluctuations, and potential funding rounds.

Not Allocating Funds for Technology Upgrades

Most companies fail to realize the need to spend on new technologies. This can reduce efficiency and limit the potential of emerging business ventures and even if new tools are being used.

How to Avoid It

- Include a dedicated line item in your startup budget for technology updates.

- Work with partners like Imenso Software to implement cost-effective solutions tailored to your business needs.

Failing to Plan for Scaling Costs

Startups often underestimate the costs of scaling, such as hiring more employees, increasing production capacity, or expanding marketing efforts. This oversight can lead to financial strain when growth accelerates.

How to Avoid It

- Build a scaling plan into your startup budget, considering potential costs for growth.

- Regularly revisit your budget as your startup expands to ensure it aligns with evolving needs.

Also Read: Proven Customer Acquisition Strategies for Early-Stage Startups

Tools and Strategies to Avoid Startup Budgeting Mistakes

Given below are the tools and strategies to avoid startup budgeting mistakes:

Leverage Technology

There are now many efficient instruments to help in organizing a budget and minimize human mistakes. Software essentials for managing the income and expenses of a startup include QuickBooks, Xero, and FreshBooks.

Seek Expert Guidance

If maintaining a budget feels daunting, then it is also wise to hire a professional or work with one. You can reach companies such as Imenso Software to get professional services regarding your specific needs and to improve your existing procedures.

Long-Term Consequences of Budgeting Mistakes

If you do not budget well, you are heading straight for serious consequences for your business. It affects investor confidence which means that attracting investors’ confidence, support and capital is difficult to achieve. It may also happen that the funds are poorly managed or the required capital is not invested because of the start-up delays when opportunities arise in the market.

Secondly, poor control over spending can indeed pose a threat to the future of your business through vulnerability to more fuss and instability. Lacking a strategic plan for the development of your startup business, you can lose focus on some important segments, including marketing, technology, or valuable resource consumption.

As a result, it is essential to know the most typical oversights one should guard against when budgeting. By pinpointing areas which are likely to cause problems and by careful planning it is possible to protect the business and build a strong future for it. Failure to use such an approach may result in expensive LSP failures that could have been avoided.

How to Create a Foolproof Startup Budget

Start with a business plan: It is necessary for your plan to clearly state your objectives, revenue model, and projected expenses.

Prioritize Expenses: Concentrate on mandatory expenses, which include the cost of creating the products and advertising.

Track Every Dollar: Keep good records of all cash flows in and out of the business.

Plan for Scaling: Make certain that the budget will allow for growth in the future without a negative impact on stability.

Conclusion

To grow your startup, you should be cautious while defining the budgeting of your start up to promote its development. Keeping track of your sources of income, expenditure and saving for rainy days means avoiding pitfalls that define many start-ups.

Since we are found in Imenso Software, we focus mainly to ensure that startup companies reduce on their cost of operations as they seek to develop effective solutions meant to deliver the best results in the marketing field.

Do not let financial mistakes be the reason they hinder their progress. Get in touch with Imenso Software and let us learn and build together. Curious to know more? On Clutch, you can read why startups partner with us for their technological requirements.

FAQs

Why do so many startups fail because of poor budgeting?

Many start-ups fail because they set their revenue for-profit targets high or believe their overhead costs are low. This flawed business logic results in bad cash flow discipline.

What is the biggest budgeting mistake startups make?

The biggest mistake is when the revenues are overestimated while the expenses are high, leaving no margins for extra expenses.

How can startups avoid running out of money?

To avoid running out of money, the following tips are recommended for any start-up business: One should follow his or her expenses, save some money for rainy days, and review any budget periodically.

Why is cash flow so important for startups?

Cash flow is the revenue generated to meet expenses, invest in revenue-generating activities, and deal with unforeseen situations. However, businesses, even money-making startups, might shut down their businesses.

How can I make sure my startup budget is realistic?

Develop your budget by using market forecasts, factual data and pessimistic prospective revenues. Refer to it as often as possible in order to monitor progress or to get back to the initial goals and objectives.

Want more information about our services?

Similar Posts

Best Practices for Streamlining Your Supply Chain Management

According to a study, only 21% of supply chain leaders at present are confident that they have a high level of resilience needed in the supply chain process. Have you ever considered how your services can be delayed even if you go over everything in detail? Are you experiencing unnecessary time lags and excessive costs […]...

How to Perform a Competitive Analysis: A Guide for Startups

Have you ever wondered how Netflix went from DVD rentals to streaming big? It all started with mastering competitive analysis. Netflix and Blockbuster were rivals in the DVD rental and video store market. However, only one of them changed with the times. Netflix took the chance to revolutionize the market with streaming. Blockbuster held the […]...

A Step-by-Step Guide to Developing a Minimum Viable Product (MVP) in 2025

Two roommates Brian Chesky and Joe Gebbia on a breezy day in October 2007 planned to rent out their apartment’s air mattresses to the attendees of a local conference. They called it “AirBed & Breakfast” and later shortened it to a fancier, “Airbnb.” At this time, they had a simple Minimum Viable Product (MVP). It […]...