How to Build a Cash Flow Forecast That Helps You Sleep at Night

“Revenue is vanity, profit is sanity, but cash is king.”

This quote popularized by former Volvo CEO Pehr G. Gyllenhammar after the global stock market crash in 1987 reflects the reality of that time. Companies with cash reserves survived much better than those that didn’t. Today, the scenario is no different.

The revenue looks good on paper. But if your cash flow is a mess, it doesn’t amount to much. Steady cash flow indicates that you are on the right track.

Cash Flow Forecast: The Key to Informed Financial Decisions

Cash flow forecasting (or cash forecasting) estimates the expected flow of cash coming in and out of your business over a specific time span. Companies with a cash flow forecast can anticipate cash shortages timely and prevent insolvency.

Cash flow management software helps with accurate tracking, analyzing, and forecasting cash flow. The tool provides real-time insights into a business’s financial health, helping to avoid poor cash flow management.

Being in the realm of financial software development for long, Imenso Software understands the importance of efficient cash flow management. Our experts create corporate cash management systems with unique functionality tied to our client’s goals. We believe in achieving project success no matter what.

Keep reading to learn about building an effective cash flow forecast so you can make informed financial decisions.

What Does a Cash Flow Forecast Consist of?

Cash flow forecast involves calculating your income and expenditure. It can either indicate a surplus of cash or a deficit. Cash flow projection is primarily a difference between your accounts receivable and accounts payable.

Accounts receivable is the money you expect to collect from different sources. These can be customer payments, deposits, rebates, bank loans, etc.

Accounts payable are the expenses you have to pay. Payroll, supplier and vendor payments, and recurring payments like rent, taxes, etc. are all examples of accounts payable.

A cash flow forecast can have some or all of the following components:

- Opening balance (for the time period you are looking at)

- Receipts (organized by cash flow item or classification)

- Total receipts

- Payments (organized by cash flow item or classification)

- Total payments

- Net movement (grouped by cash flow item or average)

- Closing balance (for the time period you are looking at)

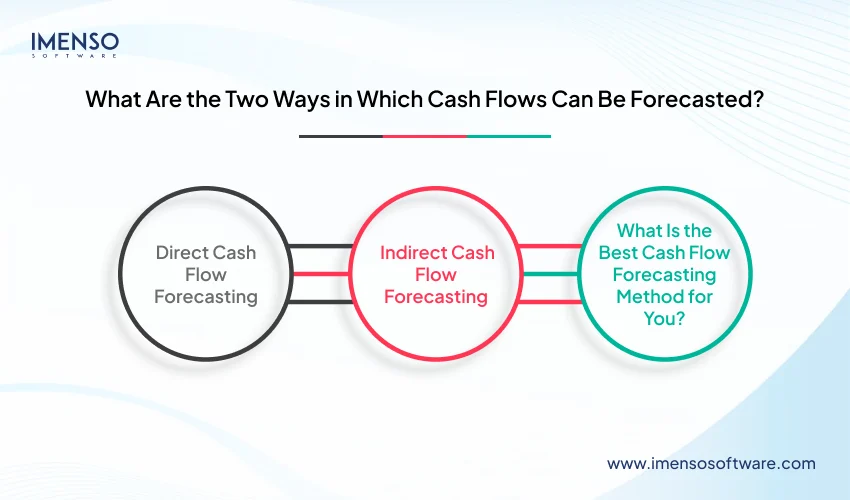

What Are the Two Ways in Which Cash Flows Can Be Forecasted?

There are two methods to build a cash flow forecast: Direct and indirect forecasting.

Direct Cash Flow Forecasting

Direct cash flow forecasting compares the cash coming in and going. It involves adding all the cash inflows and subtracting outflows in your cash status over a specific time. Direct cash flow forecasting is usually done for a short time period. Thus, the projection tends to be highly accurate. Direct cash flow forecasting gives a good picture of a business’s working capital.

Indirect Cash Flow Forecasting

Indirect cash flow forecasting covers the long-term. It is done based on the forecasted income statements and balance sheets.

Indirect cash flow projection gives the business an insight into how much funds (or cash) are available for growth or expansion initiatives.

What Is the Best Cash Flow Forecasting Method for You?

Neither of the cash flow forecasting methods described above is better than the other. The best one for you depends on the size and complexity of your business. Small businesses with limited cash flow history can benefit from direct forecasting.

However, for medium or large-scale businesses, indirect forecasting may be better. This is because such companies have complex revenue structures and multiple transactions. Indirect cash flow forecasting gives a detailed view of your future cash flow needs.

Besides, a direct forecast is appropriate for businesses that need short-term forecasting. It is also suitable for those who don’t have access to historical financial statements. Indirect forecasting is a better option for those who need long-term forecasting based on comprehensive data.

Also Read:

7 Must-Have IT Solutions to Boost Workflow Efficiency in Startups

Product Roadmap for Startups: Aligning With Your Business Strategy

The Role of Data in Feature Prioritization: Making Better Decisions

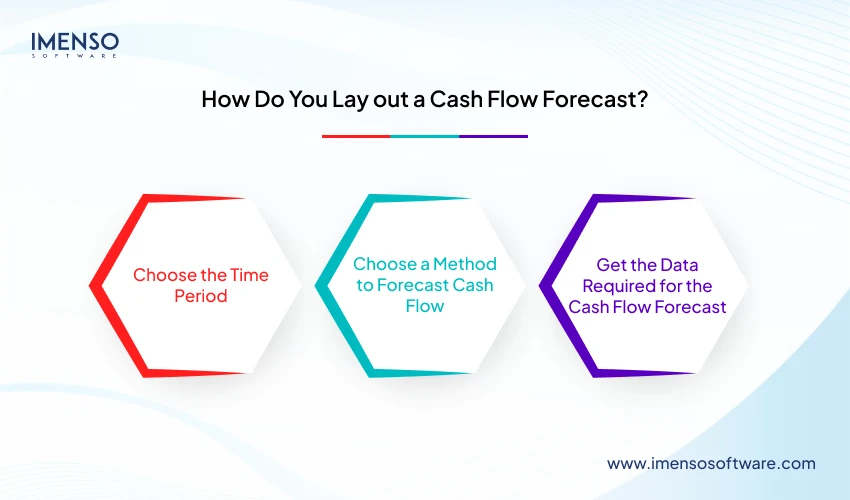

How to Create a Cash Flow Forecast?

Cash flow forecasting for startups and other businesses requires two things: The time frame for which you want to predict the cash inflow and outflow and the cash flow forecasting method (direct or indirect).

1. Choose the Time Period

Pick from short-term, medium-term, long-term, or mixed-period forecasting.

Short-term forecasting: These are the shortest cash flow projections spanning just a month or less (days or weeks) into the future. They are suitable for short-term liquidity planning. This type of forecasting is best for small businesses. This is because cash inflows and outflows are shown as they occur. So, small businesses plan better and manage payments because they have less credit to draw on.

- Medium-term forecasting: This type of forecasting considers a period from two to six months into the future. It helps businesses see how to minimize interest and debt and mitigate risk.

- Long-term forecasting: These forecasts look six to 12 months into the future. The projection helps businesses analyze where they stand in relation to growth strategy and capital projects. These cash flow forecasts help with long-term future planning.

- Mixed-period forecasting: Mixed-period forecasts combine more than one time period. They might contain daily cash flows spanning a few weeks, and weekly cash flow forecasts looking at a month or more. This type of projection helps with detailing cash flow visibility in critical areas at a particular point in time.

2. Choose a Method to Forecast Cash Flow

Cash flow forecasting can be done through the direct method and the indirect method. Both of them have been described above. Here’s a quick rundown of both.

The direct method builds the forecast based on actual cash earned and spent in a specific timeframe. It is best suited for short- to medium-term forecasts.

The indirect method is based on forecasted income statements along with balance sheets. It’s used for longer-term future planning.

3. Get the Data Required for the Cash Flow Forecast

The final step is to get the data needed to calculate your cash flow projection. The following is the type of information you’ll need.

- Financial statements: These include income statements, balance sheets, cash flow statements

- Taxes: Data from the sales tax reports

- Payroll: This includes wage and tax reports deductions reports, and payroll benefits

- Opening balance: This is your balance at the beginning of the examined period

- Closing balance: The balance at the end of the chosen time period

- Receivables: This is the anticipated sales for the next period

- Payables: Anticipated expenses for the upcoming period

Once you have the above data, use the following formula to calculate cash flow: estimated cash in – estimated cash out

Add the figure you get to your opening balance.

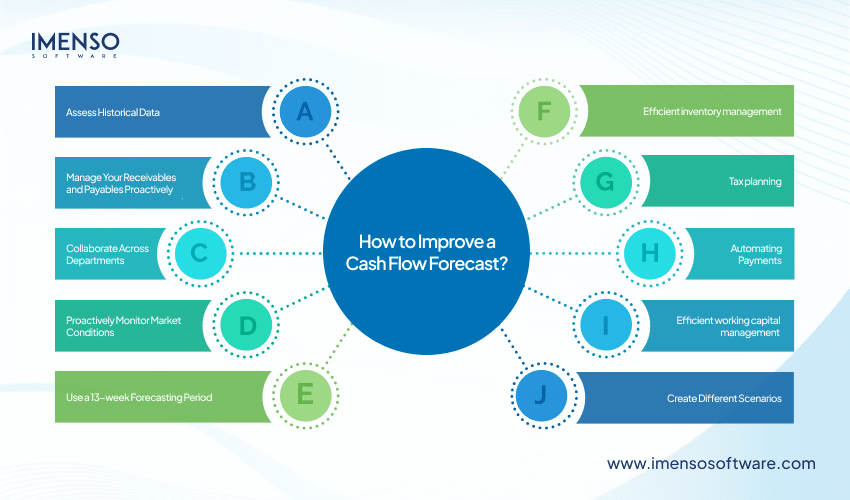

How to Improve a Cash Flow Forecast?

Efficient and accurate cash flow forecasting is critical to the success and sustainability of any organization. Here are some proven ways to improve your projection.

1. Assess Historical Data

A careful assessment of your company’s past and financial data is critical to optimizing your forecast. Use advanced analytical tools such as regression analysis to uncover trends and patterns. Statistical techniques such as predictive modeling help reveal insights that you can otherwise overlook.

2. Manage Your Receivables and Payables Proactively

Accounts receivable and accounts payable are the trade debts that you owe to suppliers and that your customers owe to you for deferred payment of invoices. If they are improperly reported, your cash flow will be negatively impacted.

If invoices do not come on due dates, no one has a clear idea of when the amount will be received. Also, the invoices should be error-free, so the necessary action can be taken. It’s critical to follow up on outstanding invoices to prevent issues later.

3. Collaborate Across Departments

Accurate cash forecasting happens when everyone across departments collaborates. The sales team gives data on market trends and revenue expectations. The purchasing department provides information on future expenses. Cross-collaboration ensures that all the necessary variables are considered and are up to date.

4. Proactively Monitor Market Conditions

Market conditions are unpredictable. Any change in interest rates makes debt costlier. Contrarily, an increase in tax reduces sales. It is thus crucial to closely monitor economic indicators, such as market movements, inflation rates, and interest rates. Revise your forecast on their basis to prevent the adverse effects of market changes on your business’s financial health.

3. Use a 13-week Forecasting Period

The longer your forecasting period, the lesser the chances of getting a detailed and accurate projection. That’s why, many companies use 13-week cash flow forecasts. It gives you adequate data for short-term accuracy. At the same time, you get the visibility for informed decision-making.

13-week forecasts help identify and plan for cash shortages several months before they become critical. Thus, it gives you enough time to arrange for bank funding. With this forecast, you can plan for cash requirements on a medium-term basis without impacting your long-term planning. A 13-week forecast is particularly suitable for investors or banks as it provides adequate data to be accurate. So, from an investor’s or bank’s perspective, it’s a measure of robust financial control.

5. Efficient inventory management

Efficient inventory management ensures that capital is not unnecessarily tied up in stock. It also prevents shortages leading to missed sales opportunities. Get a clear understanding of the demand patterns for your products. This enables you to know when you’ll be needing more or less resources or stock. This, in turn, will let you optimize production and purchasing.

6. Tax planning

Tax planning involves comprehending and implementing tax strategies to minimize the tax burden legally. It is done with full compliance with existing tax obligations.

Businesses can minimize their tax liability by leveraging available deductions tax credits and exemptions. This gives them more capital to reinvest in the business. It also reduces the uncertainty surrounding cash projections.

7. Automating Payments

Automated payment systems reduce the chances of human errors arising due to manual data entry. This in turn prevents errors such as late payments and duplicate payments. Automating payments also ensures timely and accurate processing of payments. The consistency offered by these payments makes way for optimal planning and forecasting of cash flows.

8. Efficient working capital management

Effective working capital management helps improve cash forecasting because it focuses on optimizing the management of cash, inventories, payables, and receivables. Effective management of all of these things helps a company ensure adequate liquidity and better financial stability. This, in turn, results in accurate cash forecasts.

Efficient working capital management allows a business to have adequate cash for its daily activities. At the same time, it does not tie excessive capital in assets that aren’t yielding much ROI.

9. Create Different Scenarios

Finance professionals often build different cash flow forecast situations. Typically, they include a best-case scenario, a worst-case scenario, and a scenario with a high likelihood of occurring. This helps with the proactive preparation of strategic plans for any financial deviations. However, it’s important to remember that while preparing for multiple scenarios is a good thing, avoid preparing for those that are out of your company’s scope.

Ensure the Financial Health of Your Business With Cash Flow Forecasting

Cash flow is the lifeblood of any business. Effective monitoring of cash flow reflects good inventory management, expansion or investment opportunities, and your business’s ability to handle debt. It ensures that you always have enough cash in hand, bringing stability to your operations and peace of mind to the one running it.

Automating cash flow offers multiple benefits. From reducing the risk of human error to increasing efficiency and alleviating overburdened workload in treasury teams. By leveraging data already in the company’s technology infrastructure, it substantially improves the quality of the forecasts produced.

At Imenso Software, we develop custom solutions for various industries. Our cash flow forecasting solutions automates the forecasting process and decreases manual effort. Our solutions are comprehensive, with a deep level of functionality to meet the requirements of businesses that need cash flow visibility to thrive. Interesting to learn more? Contact us today to get started.

We’re honored to mention that our efforts have been recognized by renowned B2B review and research platforms such as GoodFirms, Clutch, MirrorView, and many more.

Want more information about our services?

Similar Posts

Unveiling the Future: A Comprehensive Guide to Generative AI

In recent years, artificial intelligence (AI) has made significant strides, and one of the most intriguing advancements is in the realm of generative AI. Generative AI is revolutionizing various industries, from art and music to healthcare and finance. This comprehensive guide aims to explore the intricacies of generative AI, its applications, challenges, and future prospects. […]...

Node.JS Vs Python: Pick the Best Backend Technology in 2022

The battle between Node.js and python for the best backend technology is always on. One is old and established while the other one is new and trending. Which will win the war? Let’s dive in. Picking the right technology stack is pivotal for a web application project. The frontend and backend technology combination decides the project cost, […]...

Tips for Streamlining Your CMS Development Process

Have you ever wondered what it takes to create a seamless and efficient Content Management System (CMS)? The process of CMS development can be a labyrinth of complexities and challenges, but with the right strategies, you can transform it into a well-oiled machine that saves you time, minimizes errors, and yields superior results. In this […]...